Student debt: Why we shouldn’t be worried

Student’s need to stop worrying about how much debt they are in, and rather take the road less traveled to financial happiness.

More stories from Trent Tetzlaff

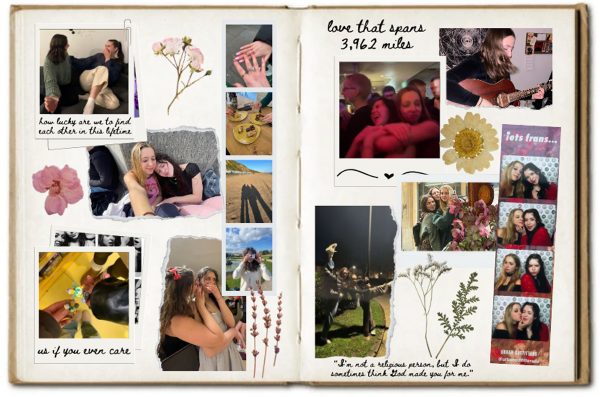

Photo by Trent Tetzlaff

Growing up, one of the most important life lessons I learned is that “the best things in life are free.”

Love, friends, family, all of these things come without a price tag. However, one thing that isn’t free is a college education, something I am so close to finishing up.

Now as I turn the corner to the final stretch of my senior year, along with thousands of other students at UW-Eau Claire, the last thing I should be thinking about is my financial situation. But the sad thing is, I am forced to.

Loans, payment plans, interest; these words continue to spin around inside my head like a tornado. It’s just very difficult to come to realize in three weeks I will step out into the world and begin paying off debt.

According to a USA Today article, in 2014 the average student loan debt after four years of schooling was $33,000.

Thankfully Eau Claire is reasonably priced. I received financial aid and I was able to work my way through college so I find myself a safe amount under the average. But some aren’t so lucky.

According to the article, many students can find themselves over $50,000 in debt depending on where they go to school and if they intend to take on graduate school.

Senior Vice President and Publisher of Edvisors Mark Kantrowitz, who runs multiple websites about paying and planning for college, said it’s all about paying your loans quickly before a lot of interest is created.

“So long as your total debt at graduation is less than your annual starting salary,” Kantrowitz said. “You should be able to pay your student loans back in 10 years or less and comfortably. When you stretch it out beyond 10 years, it can start having an impact on other life events, like paying for your children to go to college.”

Although I am in debt and probably will never make a pretty penny as a journalist, I have decided to take a step back and just simply breathe.

Forget worrying about bills, loans, your salary and how long you will be paying off your student debt and start living in the moment is what I have begun to tell myself, and it’s something the rest of the world should begin to do as well.

Being positive about your financial situation as a college student is the best mindset you can have. In a few weeks I will need to get my life together and start paying off bills with my big boy paychecks, but that is then and now is now.

If I had to live the rest of my life constantly in fear of my student debt I would go insane. Instead I find myself putting my financial worries on the backburner and living life day by day and having fun with it, while also making sure I stick to a decent budget.

No matter how much debt you have coming out of school, the worries aren’t worth it in my mind, especially if you are able to find a job fairly early in your search.

So go out to dinner with your friends to celebrate your graduation and don’t worry about the tab. You only live once.