Expiration of Federal Perkins Loan Program puts college affordability into question

Longest-running student loan program ‘filled a pretty important gap’ for students with high financial need

More stories from Rachyl Houterman

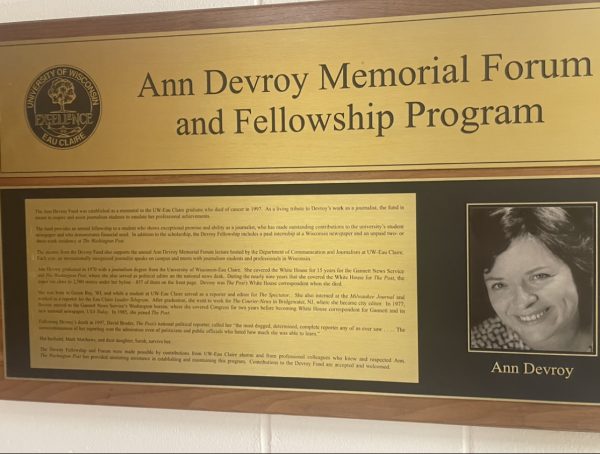

Photo by Sam Farley

The Federal Perkins Loan Program expired on Sept. 30, creating a financial gap for students who rely on it to help pay for college.

Hundreds of students at UW-Eau Claire will have to find another way to fill the gap of college affordability following the expiration of the Federal Perkins Loan Program on Sept. 30.

The Perkins Loan Program, which provided low-interest rate loans to students with significant financial need for over 50 years, expired after a bipartisan bill to extend it was blocked by Sen. Lamar Alexander (R-TN) on the Senate floor on Sept. 28.

Sen. Tammy Baldwin (D-WI) authored the rejected bill that would have extended the program for two more years.

“Students and families are depending on Washington to get the job done, not block college affordability,” Baldwin said in a press release. “I will continue to fight to extend this support for America’s students, and I hope Americans urge their Senators to join this bipartisan effort and act now to protect the future of this program.”

Kim O’Kelly, the director of operations at Blugold Central, said the program provided about 900 Eau Claire students with about $2.2 million in awards the 2016-17 academic year.

Students at Eau Claire were eligible to receive a maximum of $3,000 in awards per academic year through the program, said Interim Financial Director Nikki Andrews.

Now that it has expired, students will have to seek alternative ways to alleviate the burden of paying for school.

Andrews said there is nothing that will be able to replace the program “one-for-one,” and students will have to defer to private loans and the like to pay for college.

“There is going to be a gap for some students,” Andrews said. “There’s no question. Perkins filled a pretty important gap for students with some of the highest need. There is no alternative right now. I think the best is going to be alternative loans.”

Students who filled out their paperwork and received their disbursement before Oct. 1 will still receive their spring disbursement for this academic year, O’Kelly said. After that, no more applications are being accepted.

Through the program, students would repay their loans to the school from which they borrowed. The federal government funded the program up until 2004, after which point schools have been using the money from repayments to fund new loans.

In 2015, the program expired but was reauthorized that December after Senate was able to reach a deal to extend it for two more years, thus beginning a process to “phase it out.”

Student Body Vice President Nick Webber said it’s difficult to tell what will happen next but that he and other student representatives will “keep fighting to get this thing (an extension bill) passed because I think that we can.”

“I think the test of time has shown that the Federal Perkins Loan Program works and has affected so many students in so many ways,” Webber said. “Even out of college, not having to pay so much in student loan debt has been excellent.”

As a student representative serving on The University of Wisconsin Student Representatives Executive Board, Webber and others sent a resolution and cover letter to members of Congress last Wednesday advocating for the continuation of the Perkins Loan Program before it expired.

“It is our firm belief that the Federal Perkins Loan Program is critical to the success of a significant number of students in the University of Wisconsin System,” the letter reads, “for it provides loans at a rate that is reasonable and affordable for those eligible.”

Webber said if students want to join the fight to reauthorize the Federal Perkins Loan Program, they should call members of Congress. Webber said students are invited to stop by the Student Senate Office (Davies Center 220) if they have questions about whom to contact “because these legislators do need to hear from the people that are affected by their decisions.”

“And it’s not something that’s too intimidating,” Webber said. “You’re over the phone, and you’re telling your story. It doesn’t have to be a novel, but they need to hear from students sending emails as well as calling congressional offices.”

Because people are lobbying for it right now, O’Kelly said she is still hopeful for the program’s revival.

“It was successful in 2015,” O’Kelly said, “so we’re keeping our fingers crossed.”