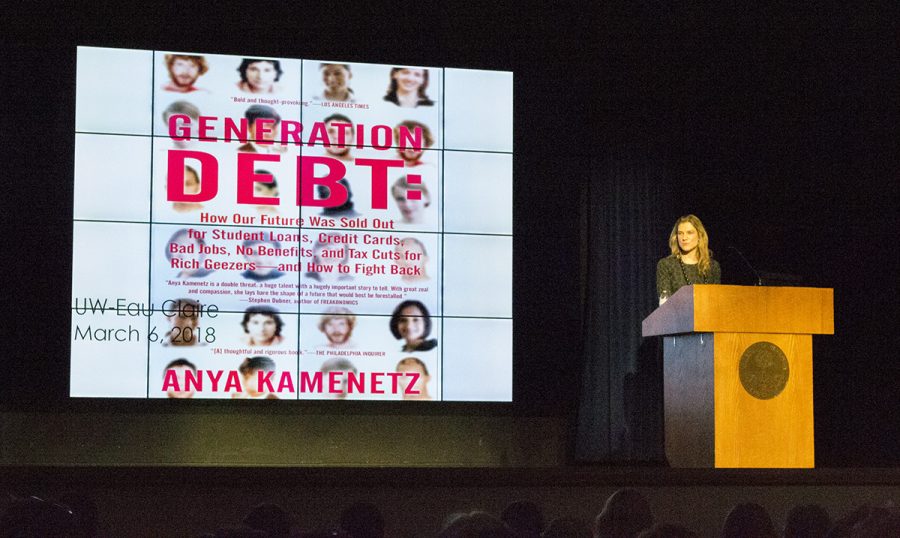

The Forum: Anya Kamenetz shares information, advice and hope

NPR education journalist talks about debt in today’s world

Photo by Kar Wei Cheng

As part of UW-Eau Claire’s The Forum series, Anya Kamenetz spoke on Tuesday night. Kamenetz said there are three types of debt that comprise America’s deficit-reality: personal debt, national debt and eco-debt.

Young people live in a world of debt, but there is still hope for a bright future, said Anya Kamenetz, an education blogger for NPR, during her presentation Tuesday night in the Schofield Auditorium at UW-Eau Claire.

“I think we have be fiercely optimistic and hopeful,” Kamenetz said.

As part of the university’s Forum series, the journalist’s talk centered around her first book, “Generation Debt.”

Published in 2006, “Generation Debt” shared stories from the lives of young people juggling low incomes, high taxes, steep student loans and climbing housing rates. The book is product of Kamenetz’s reporting for the Village Voice (an online news source), according to her website. She wrote the book when she was 25 years old.

Today, Kamenetz is NPR’s lead digital education blogger. Her background covers technology, innovation, sustainability and social entrepreneurship.

Kamenetz admitted “Generation Debt” had received mixed reviews, notably from one Slate writer who argued Kamenetz and other millennials were “whining” about their debt. Kamenetz was quick to provide factual evidence to show that debt, in all means of the word, is increasing.

Although it’s been 12 years since “Generation Debt” first hit shelves, Kamenetz said the trends in the book “are still a reality today.”

Kamenetz said there are three general types of debt that create America’s fiscal reality.

The first kind of debt is personal debt — the kind that is racked up when individuals take out loans to pay for college or a car or a house. Americans’ total consumer debt totaled to $13.15 trillion in the fourth quarter of 2017, according to the Federal Reserve Bank of New York.

Kamenetz addressed the personal debt obtained specifically by attending college.

As states raise the price of higher education, Kamenetz said students continue to take out more loans to cover the growing costs.

“There is a very strong relation between college tuition and college debt,” Kamenetz said.

She said the substantial amount of debt young college graduates carry hinders them for years to come.

According to College Factual, 58 percent of undergraduates at Eau Claire utilize student loans. The average Blugold takes out $6,244 in loans per year. After completing a four-year degree, Eau Claire graduates have an average total of $24,976 in student loans.

This is lower than the Wisconsin state average for student loan debt, which totals to $30,059, according to 2016 data from the Institute for College Access and Success. Including debt from both public and private colleges and universities, Wisconsin’s sits in the middle of state debt averages.

“We’re hanging an albatross around the neck of those who are supposed to be carrying our future,” Kamenetz said.

Personal debts are even harder to overcome because the job market, job function and job availability are adapting to developments in the digital world, Kamenetz said.

The national deficit also is a factor in America’s debt way-of-life. America’s federal debt is about $20 trillion. Kamenetz said a debt this high could potentially spell economic disaster for the United States.

Finally, Kamenetz explained eco-debt. The world is in eco-debt, she said, because humans have been using more fuel than is sustainable. To fix this problem will require a complete reorganization of how we consume energy.

When graphed and placed next to each other, personal debt, national debt and eco-debt all share the same upward trend. Kamenetz said she is worried the three types of debt will reach a peak and then crash.

Yet Kamenetz is optimistic. She does not discredit higher education though it is a large source of personal debt. Research says employers look for skills sets manifested in a liberal arts education, Kamenetz said.

It is important to fuse work, passion and worldly impact together, Kamenetz said, encouraging the audience with her advice. Kamenetz said she believes millennials have the capability to improve America’s relationship with debt.

“We need a lot of change, and young people are going to influence that,” Kamenetz said.

However, Kamenetz said, to live a life of “freedom,” one must lead a life free of “financial exploitation.”

To do so, borrow less money, buy less and save more. Divide paychecks 50 percent needs, 20 percent savings and 30 percent wants, Kamenetz said.

Juliet Kratochwill, a first-year business marketing and management student, said Kamenetz’s advice was “applicable.”

“I will have college debt and I’m interested to know what my future would look like,” Kratochwill said.

Like Kratochwill, Kamenetz often thought of America’s future during her presentation.

“I have a lot of trust in young people,” Kamenetz said. “I don’t think (they) take no for an answer.”

Neupert is a fourth-year journalism student at UW-Eau Claire. She is the executive producer of Engage Eau Claire on Blugold Radio Sunday. In her spare time, Neupert's working on becoming a crossword puzzle expert.