Trump’s 100-Day Plan: part four

President-elect Trump plans to introduce several economic-driven acts in his first 100 days of office

Throughout his campaign, many Trump supporters would chant “Build that wall,” referring to Trump’s plan to build a wall on the Mexican border. This section of the plan reiterates those plans. (Submitted)

December 8, 2016

President-elect Donald Trump plans to introduce acts of legislation in his first 100 days when he takes office Jan. 20., including his often-mentioned tax plan, an act to curtail offshoring businesses, as well as following through with his promise to repeal Obamacare.

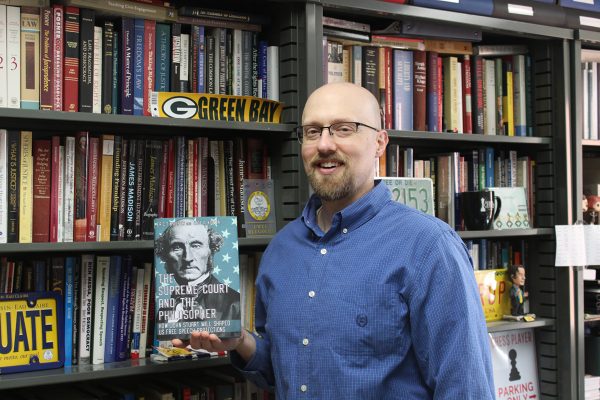

Department of economics chair and UW-Eau Claire professor Thomas Kemp noted Trump’s plan is lacking details and specifics, so it’s unclear how his initiatives will be accomplished.

However, Trump talked throughout his campaign about his tax relief plan, which would cut taxes for middle class Americans. After he takes office, he’ll introduce his plan to grow the economy, create jobs and reduce taxes for the middle class.

Specifically, Trump plans to reduce the number of tax brackets from seven to three. This would simplify the tax codes and benefit people who are unable to employ someone do their taxes for them, Kemp said.

“Many presidents have promised to simplify the tax code … but I have yet to see it significantly simplified,” Kemp said.

Trump’s tax plan is essential because it will benefit the middle class, which determines long-term economic trends, College Republicans Chair Mitchel Orlovksy said.

“Ultimately, this is something that Trump sees as an issue,” Orlovsky said. “He sees it as important and I think a lot of other politicians would agree with that.”

Additionally, the president-elect will propose his plan to end the Offshoring Act. He has said many times he wants to protect Americans from businesses moving abroad and workers losing their jobs to people overseas, and this is a way he wants to go about solving that problem.

Implementing this act would be hard to do, Kemp said, because placing a tariff on only a few corporations would be problematic.

“A tariff proposal abroad would be extremely difficult to implement because it singles out individual firms rather than industry as a whole,” Kemp said.

College Democrats member Anna Schmidt said she hopes to see Trump combat offshoring, which will benefit American workers.

“I think we should work on keeping industry here and keeping jobs here,” Schmidt said.

The document also lists an energy and infrastructure act, which will leverage public-private partnerships, creating $1 trillion in investments. Trump said this plan will be “revenue neutral,” which means it will not cost the government. He has not explained how he intends to do it.

He also expressed his plans to redirect education dollars to give parents the right to send their children to the type of school of their choice.

Since education is state funded, Kemp said that could mean Trump would aim federal funding towards education. Otherwise Congress could enact a law that requires state funding to have certain requirements. However, it’s hard to tell because he hasn’t released these details, Kemp said.

Finally, the plan reiterates Trump’s intentions to replace Obamacare. Since being elected, he has said he won’t replace it but instead will revise what already exists.

Trump’s plan concludes with five more acts he hopes to introduce once he takes office.