Health insurance costs rise

Rising healthcare costs and federal mandates are driving higher pricetag, insurer says

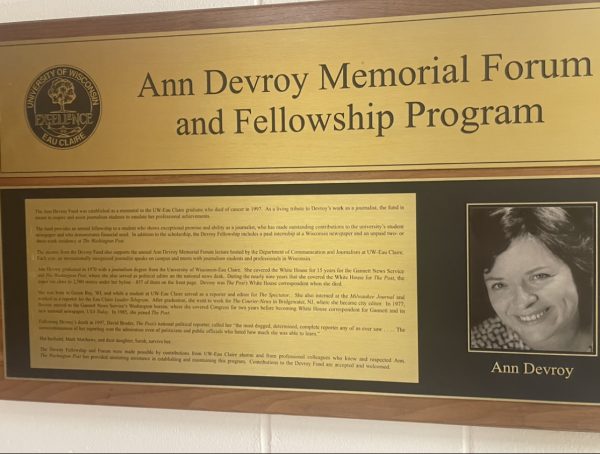

Photo by FILE PHOTO

Last fall freshman Ryan Battist went to Student Health Service for a physical and to see if he has asthma – a condition he said he thinks came from living in the dorms. Students will pay more for campus-sponsored health insurance again this year.

January 29, 2015

UW-Eau Claire students will pay more this year for campus-sponsored health insurance after a local insurer rose rates to meet climbing medical costs and new federal standards.

Don Southard, of Southard Insurance, Eau Claire’s student insurance provider, said he expects the student health package price tag to rise with further Affordable Care Act mandates and climbing healthcare costs in coming years.

The annual rate for student health insurance has jumped about $500 since Southard adjusted the student plan to comply with ACA standards in August 2013. Health insurance may eventually become too costly and underused for schools to offer, Southard said.

“Inevitably down the road schools won’t offer health insurance,” he said. “There are ways to counteract that, but I don’t think that will happen.”’

Benefits

The student plan covers 80 percent of co-pay and features a $500 deductible. Plus, insured students will avoid a cash penalty levied through tax returns on uninsured adults this year.

“We can’t do any more than we’re doing, maybe when the fines come we’ll see more people sign up,” Southard said.

Southard adopted carrier Nationwide Insurance after his former carrier Columbia Insurance dropped health insurance services entirely ahead of the ACA rollout.

New benefits this year include:

— No pre-existing conditions clause

— No higher payments for older students

— Out-of-pocket limit reduced to about $6,000

Total costs

Southard said enrollment dropped last year after the cost jumped from about $900 two years ago to about $1,300. He expects enrollment to drop again in coming years, he said.

Ashley Yunek, freshman, gets health insurance through her parents. But if she lost coverage tomorrow, she wouldn’t rush to re-enroll, she said.

“That’s probably not the first thing I would think about,” she said.

Under the annual plan, which began Aug. 2 and runs through July 2015, single students will pay about $1,475 this year for insurance; adding a spouse will cost $5,079, and each child costs $3,420 this year.

Unlike many ACA plans, student health insurance doesn’t offer subsidies.

UW-Stout, -Madison and Eau Claire offer health plans through different providers — Student Assurance Services handles health care packages for other universities and colleges in the UW System.

Promotion

Student Senate sponsors student health insurance, and each year, Senate sends a letter with insurance information to students, hangs posters and promotes the student health plan on its Facebook page and website.

Southard spends about six days a year behind a table in the Davies Center to answer questions about plans for passing students.

Jake Wrasse, student body vice president, said Senate has had to promote the plan more as costs have increased.

Wrasse said he’s “dissapointed” the cost of health insurance continues to rise. Shelling out for both tuition and health insurance is a challenge, he said.

“Neither comes cheap,” Wrasse said. “But it’s important both are

accessible.”